Hey there, Champions!

Welcome to Kobo Snacks - where we make finance fun! After a rollercoaster year, I've decided to pivot from sharing just my learnings to serving up finance in a more snackable form. This isn't your typical LinkedIn content; here, we mix humor with finance to make learning enjoyable.

So from "Learnings from Jam" to something more... snackable.

Introducing Kobo Snacks - where finance gets a fun twist! This is all about making the world of money not just accessible but also enjoyable. No more dry, confusing jargon; here, we sprinkle our finance news with humor and clarity.

What's on the Menu?

Weekly Feasts: A more in-depth look at financial trends, tips, and tales every week with jokes that will tickle your fancy.

Eventually, we will launch Daily Bites: Fresh, daily servings of the latest in money news, delivered straight to your inbox.

We're keeping things light, fun, and educational because learning about finance should be as enjoyable as snacking on your favorite treats. Let's grow our money smarts together, shall we?

Join the Feast! You're cordially invited to our exclusive Kobo Snacks Community on X, where we'll share the juiciest bits of info and interact directly with you. Click here to join the fun: https://x.com/i/communities/1883541808891809807

Let’s get to the Money News

Biggest Nigerian News:

PWC has highlighted several challenges that might keep foreign investments at bay in Nigeria for 2025. Here’s what you need to know to navigate this landscape.

What's a Real Interest Rate?It's the interest rate after you've subtracted inflation. Normally, you want this to be positive because it means your money is growing in real terms (after accounting for rising prices).

The Problem in Nigeria: Right now, inflation in Nigeria is running high - we're talking about it outpacing the interest rates on investments like bonds or savings accounts. If inflation is, let's say, 30%, and the interest rate on your investment is only 20%, you're losing purchasing power. That 20% interest doesn't keep up with the rising cost of living, so your money's value shrinks.

Diaspora remittances might be the silver liningPwC noted that diaspora remittances, a critical source of foreign exchange for Nigeria, have averaged $20 billion annually over the past decade.

Nigeria’s public debt profile rose to N142.32 trillion as of September 30, 2024, compared to N134.3 trillion as of June that same year, the Debt Management Office (DMO) has revealed.

This means each Nigerian could owe about N656,514 debt stock per capita when N142.32 trillion is divided by the country’s estimated population of 216.78 million.

Biggest Global News

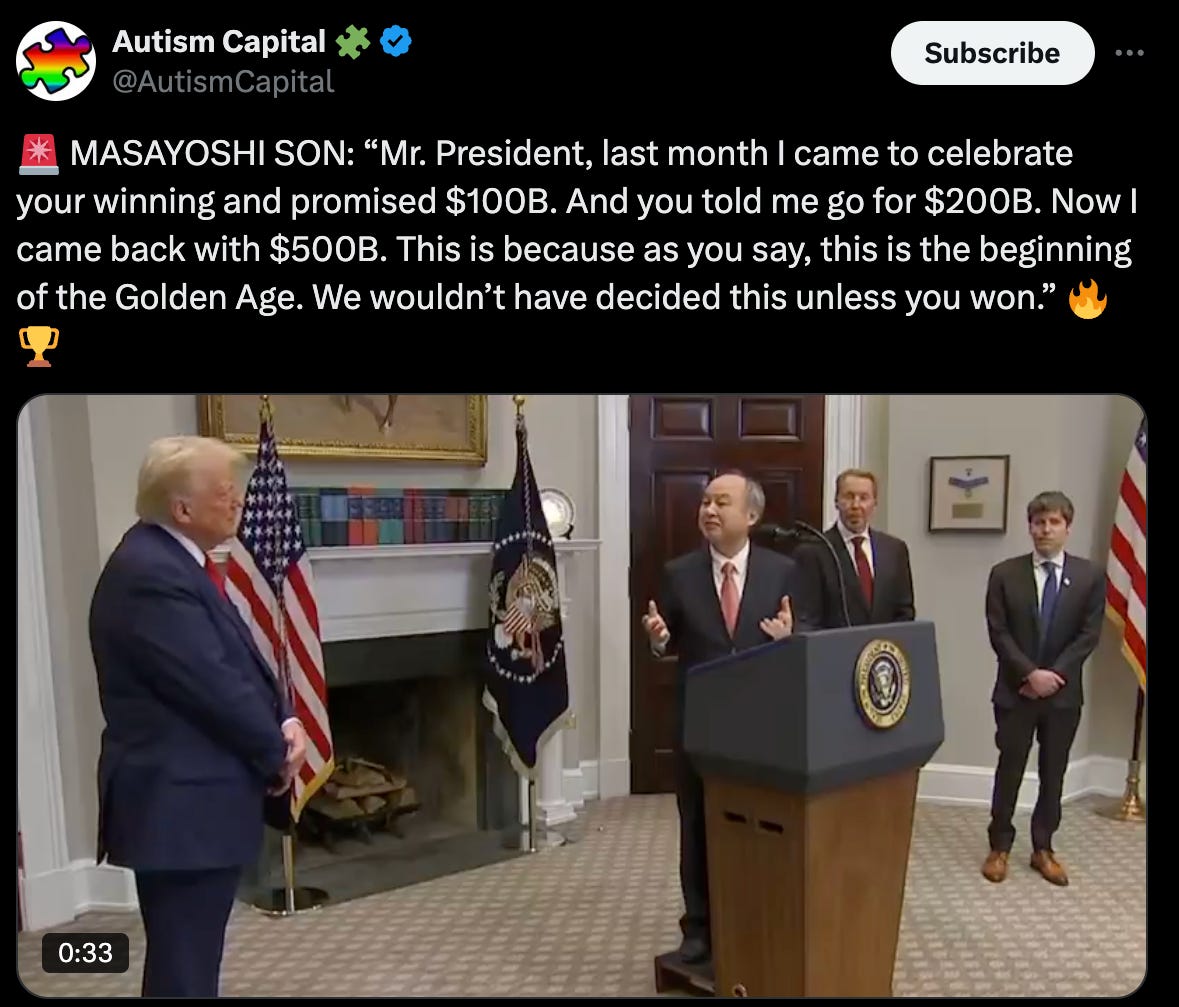

1. So a few days ago, Masayoshi who is one of the greatest investors of all time, promised to invest 100bsss into America in the next 4 years and Trump was negotiating live to raise it to 200 billion..

Guess what, we got news that it’s up from 100 to $500 billion. Trump had a busy week for suree.

Elon Musk took to X to cast doubts on the financial feasibility of this plan, sparking a notable exchange with the CEO of OpenAI.

Meanwhile, China's DeepSeek has introduced DeepSeek-R1, an open-source AI model that outperforms some of the current market leaders in efficiency and cost-effectiveness, potentially shaking up the AI industry.

The Reactions to China’s ChatGPT

3. Trump launched his own cryptocurrency last week, stirring both gains and losses in the market. If you're considering investing, or if you're confused about how to start, feel free to reach out. We're here to guide you through the process.

Aside from profit being made, people lost a ton of money as well.

Here are some reactions;

If you enjoyed this Edition please leave a comment!!

Join the Feast! You're cordially invited to our exclusive Kobo Snacks Community on X, where we'll share the juiciest bits of info and interact directly with you. Click here to join the fun: https://x.com/i/communities/1883541808891809807

Happy Snacking!!

Share this post